Seit Anfang 2021 erleben wir weltweit einen deutlichen Anstieg der Inflation und damit die erste nennenswerte Inflation seit Jahren. Ganze Generationen, die in ihrem Leben noch keine Inflation erlebt haben, werden nun damit konfrontiert. Doch was bedeutet Inflation, wie entsteht sie, und welche Auswirkungen hat sie auf Wirtschaft und Verbraucher?

Was ist Inflation?

Unter Inflation versteht man den Anstieg des Preisniveaus von Waren und Dienstleistungen in einer Volkswirtschaft über einen bestimmten Zeitraum. Einfacher ausgedrückt: Geld verliert an Kaufkraft, da man mehr bezahlen muss, um die gleichen Waren und Dienstleistungen zu erhalten. Wenn zum Beispiel ein Fernseher im Jahr 2022 1.000 € kostet und derselbe Fernseher im Jahr 2023 1.100 € kostet, beträgt die jährliche Inflationsrate [für diesen Fernseher] 10%.

Die Inflation wird jedoch in der Regel nicht auf der Grundlage eines einzelnen Produkts gemessen, sondern anhand eines "repräsentativen Warenkorbs". Dieser Warenkorb spiegelt die Konsumgewohnheiten der Durchschnittsverbraucher wider und umfasst verschiedene Artikel aus unterschiedlichen Kategorien wie Lebensmittel, Kleidung, Wohnraum, Gesundheitsversorgung, Bildung, Unterhaltung und mehr. Die Idee hinter einem repräsentativen Warenkorb ist es, einen Querschnitt der Ausgaben zu erhalten, die die Menschen in einer bestimmten Region tatsächlich tätigen. Nach der Zusammenstellung werden die Preise für die einzelnen Posten des repräsentativen Warenkorbs in regelmäßigen Abständen überwacht. Änderungen dieser Preise werden dann zur Berechnung des Verbraucherpreisindex (VPI) herangezogen, mit dem gemessen wird, wie sich die Durchschnittspreise der im Warenkorb enthaltenen Waren und Dienstleistungen im Laufe der Zeit verändern.

Die Zusammensetzung des repräsentativen Warenkorbs ist entscheidend für die Inflationsberechnung und führt häufig zu Diskussionen über die Aussagekraft der ausgewiesenen Inflationsraten. So ist es z. B. wichtig, dass der Warenkorb Veränderungen der Konsumgewohnheiten (z. B. aufgrund der Einführung neuer Produkte und Dienstleistungen) angemessen widerspiegelt oder dass die Gewichtung einzelner Waren und Dienstleistungen ihren tatsächlichen Beitrag zu den Gesamtausgaben eines Durchschnittsverbrauchers korrekt wiedergibt (z. B. angemessene Berücksichtigung der Energiekosten).

Wie kommt es zur Inflation?

Die Inflation kann durch verschiedene Faktoren ausgelöst oder beschleunigt werden, die sich in eine nachfrageseitige und eine kostenseitige Inflation unterteilen lassen:

- Unter durch Nachfrage ausgelöste Inflationn, übersteigt die Nachfrage nach Waren und Dienstleistungen das Angebot. Aufgrund der Knappheit des Angebots können die Unternehmen die Preise für ihre Waren und Dienstleistungen erhöhen. Ursachen für eine solche Nachfragesteigerung können ein erhöhter Konsum der Haushalte, wachsende staatliche Investitionsausgaben oder steigende Unternehmensinvestitionen sein. Diese zusätzliche Nachfrage, sei es seitens der Haushalte, des Staates oder der Unternehmen, kann durch verschiedene Faktoren ausgelöst oder beschleunigt werden. In diesem Zusammenhang werden häufig die Geldpolitik der Zentralbanken (z. B. der Europäischen Zentralbank) oder das allgemeine Zinsniveau als wichtige Triebkräfte der Nachfrage genannt. Wenn sich beispielsweise Haushalte aufgrund niedriger Zinsen (d. h. niedriger Zinskosten) "billiges" Geld leihen können, werden sie dies wahrscheinlich tun und das Geld für den Kauf von Waren und Dienstleistungen ausgeben.

- Inflation mit Kostendruck beinhaltet einen allgemeinen Anstieg des Preisniveaus aufgrund höherer Produktionskosten für Unternehmen, die an die Endkunden weitergegeben werden. Höhere Produktionskosten können zum Beispiel durch gestiegene Rohstoff- und Energiepreise oder Löhne entstehen. Dieser Anstieg der Produktionskosten kann durch verschiedene Faktoren ausgelöst oder beschleunigt werden. In Deutschland erlebten wir beispielsweise im Jahr 2022 einen Anstieg der Rohstoff- und Energiepreise, der auf den russischen Einmarsch in der Ukraine und die damit verbundenen Sanktionen gegen Gaslieferungen zurückzuführen ist. Als Reaktion darauf gaben die Unternehmen ihre gestiegenen Produktionskosten an die Kunden weiter, was letztlich zu einem inflationären Anstieg führte. Ein weiterer Treiber für die kostentreibende Inflation, der heute aufgrund der von der Trump-Administration angekündigten Maßnahmen von großer Bedeutung ist, sind Zölle. Die Auswirkung von Zöllen auf die Inflation entfaltet sich nicht nur aufgrund höherer Preise für aus anderen Ländern importierte Endprodukte, sondern auch aufgrund höherer Produktionskosten für Unternehmen, die zur Herstellung ihrer Produkte Rohstoffe und Halbfertigwaren importieren müssen.

Auswirkungen der Inflation

Die unmittelbare Auswirkung der Inflation ist ein Kaufkraftverlust, d. h. die Verbraucher können für das gleiche Budget weniger Waren und Dienstleistungen kaufen als in einem früheren Zeitraum. Daher wird die Inflation auch als Währungsabwertung bezeichnet, da das Geld an Wert verliert.

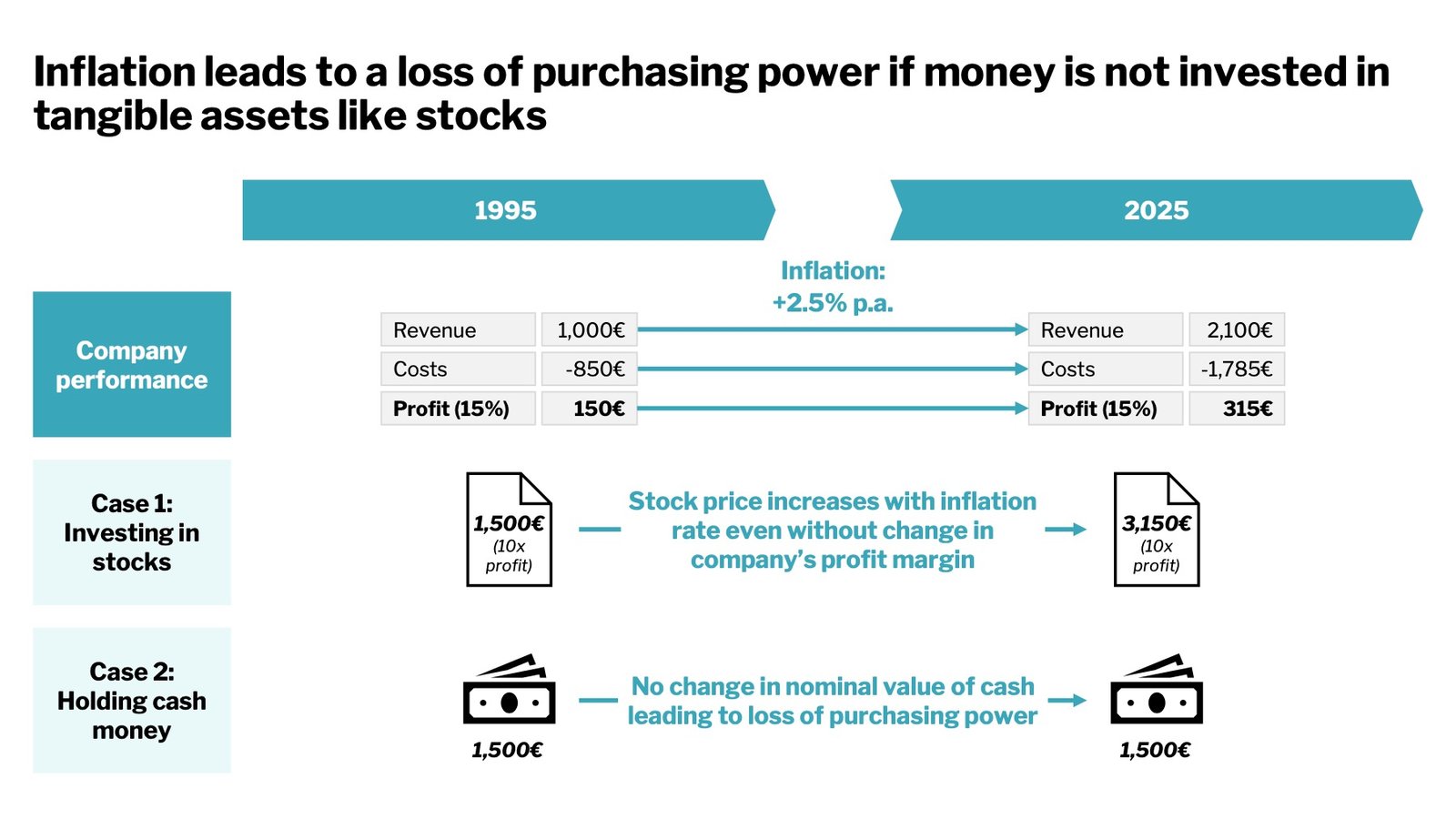

Diese Währungsabwertung trifft vor allem Sparer, die ihr Geld in bar oder auf niedrig verzinsten Konten angelegt haben. Da diese Anlageformen keine oder nur geringe Renditen abwerfen, erleben die Sparer in Inflationszeiten einen negativen Realzins. Das bedeutet, dass die Inflationsrate den nominalen Zinssatz, den die Sparer auf ihr (angelegtes) Kapital erhalten, übersteigt, was zu einem Kaufkraftverlust für den Sparer führt. Im Gegensatz zu Bargeld oder niedrig verzinsten Konten dienen Sachwerte wie Aktien oder Rohstoffe in der Regel als wirksame Instrumente zum Schutz von Geld oder Vermögen vor Entwertung. Dies liegt daran, dass der Wert von Sachwerten in der Regel mit der Inflationsrate "wächst", wodurch negative Realzinsen vermieden werden, und die Kaufkraft stabil bleibt.

Dies lässt sich am Beispiel einer Investition in Aktien veranschaulichen: Ein Produkt, das heute 1.000 € kostet, würde bei einer durchschnittlichen Inflationsrate von 2,5% pro Jahr in 30 Jahren auf 2.100 € steigen. Dies hat grundsätzlich keine Auswirkungen auf die reale Gewinnentwicklung des Unternehmens, da der nominale Gewinn durch die inflationsbedingten Preissteigerungen steigt. Erzielt das Unternehmen z.B. eine Gewinnspanne von 15%, so würde der Gewinn pro Produkt bei sonst unveränderten Bedingungen von 150€ auf 315€ steigen. Unter der Annahme, dass die Aktien des Unternehmens an der Börse mit dem Zehnfachen des Gewinns bewertet werden, läge der heutige Aktienkurs bei 1.500 €. Steigt der Gewinn in 30 Jahren bei unveränderter Gewinnbewertung auf 315 €, würde der Aktienkurs auf 3.150 € steigen. Der Aktienkurs hätte sich allein durch die Inflation mehr als verdoppelt, so dass die Kaufkraft des Geldes oder des Vermögens in den 30 Jahren erhalten bliebe.

Ist Inflation schlecht?

Eine moderate Inflationsrate von etwa 2% pro Jahr wird von den meisten Zentralbanken als normaler Bestandteil einer gesunden Wirtschaft angesehen. Dies liegt daran, dass eine moderate Inflation Verbraucher und Unternehmen zu Investitionen anregt, da das Geld in der Zukunft etwas an Wert verlieren wird (siehe das obige Beispiel zu Aktieninvestitionen). Dies wiederum fördert die Wirtschaftstätigkeit.

Eine höhere Inflation wird jedoch als ungesund für die Wirtschaft angesehen, da sie nicht nur den oben beschriebenen Kaufkraftverlust mit sich bringt, sondern auch Planungsunsicherheit für Unternehmen (insbesondere bei schwankenden Inflationsraten).

Außerdem kann eine hohe Inflation zu sozialen Auswirkungen und Umverteilungen führen. Dies liegt daran, dass verschiedene soziale Gruppen unterschiedlich stark von der Inflation betroffen sein können. Einkommensschwächere Schichten sind in der Regel unverhältnismäßig stärker von der Inflation betroffen, da sie einen größeren Teil ihres Einkommens für Grundbedürfnisse wie Lebensmittel, Miete und Energie aufwenden müssen und in der Regel weniger Vermögenswerte wie Aktien oder Immobilien besitzen, um ihre Kaufkraft zu erhalten (siehe das Beispiel oben).

Maßnahmen zur Senkung der Inflation

Maßnahmen zur Verringerung der Inflation lassen sich in geldpolitische, fiskalpolitische und angebotsseitige Maßnahmen unterteilen:

- Eine der wichtigsten geldpolitische Maßnahmen zur Bekämpfung der Inflation ist die Erhöhung der Zinssätze durch die Zentralbank. Höhere Zinssätze erschweren die Kreditaufnahme, was zu einem Rückgang der Ausgaben und Investitionen und damit der Nachfrage führt. Daher kann eine Zinserhöhung zu einer Verlangsamung der Wirtschaft führen, was die Zentralbanken in der Regel in das Dilemma bringt, ein Gleichgewicht zwischen Inflationskontrolle und wirtschaftlicher Abkühlung zu finden.

- Fiskalpolitische Maßnahmen Dazu gehören die Kürzung staatlicher Investitionen oder Steuererhöhungen, um die Gesamtnachfrage zu senken und den Preisdruck zu mindern. Ähnlich wie bei Zinserhöhungen muss hier eine mögliche Konjunkturabschwächung als Kollateralschaden in Betracht gezogen werden.

- Zusätzlich zu den geld- und steuerpolitischen Maßnahmen, die sich hauptsächlich auf die Nachfrageseite konzentrieren, angebotsseitige Maßnahmen können ebenfalls die Inflation verringern. Dazu gehören Maßnahmen, die das Angebot an Waren und Dienstleistungen erhöhen, um die Nachfrage zu decken. Beispiele hierfür sind Produktivitätssteigerungen, die Erleichterung des Zugangs zu den Arbeitsmärkten, Freihandelsabkommen oder Maßnahmen zur Beseitigung von Engpässen in der Lieferkette.

Die Wirksamkeit dieser Maßnahmen ist je nach den spezifischen wirtschaftlichen Bedingungen und Ursachen der Inflation unterschiedlich. Häufig ist eine koordinierte Anwendung mehrerer politischer Instrumente erforderlich. Auch die Glaubwürdigkeit der Politik ist ein entscheidender Faktor: Wenn die Wirtschaftsakteure davon überzeugt sind, dass die Regierung und die Zentralbank die Inflation wirklich bekämpfen, kann dies zu einer wirksameren Umsetzung der Maßnahmen führen.

Schlussfolgerung

Zusammenfassend lässt sich sagen, dass die Inflation ein komplexes wirtschaftliches Phänomen mit vielfältigen Auswirkungen auf Gesellschaft und Wirtschaft ist.

Während eine moderate Inflation als normaler Bestandteil einer wachsenden Wirtschaft angesehen werden kann und Anreize für Ausgaben und Investitionen schafft, können hohe oder unvorhersehbare Inflationsraten erhebliche negative Folgen haben. Inflation führt zu Kaufkraftverlust, Unsicherheit für Unternehmen, Umverteilungseffekten und sozialen Auswirkungen, insbesondere für Bevölkerungsgruppen mit geringem Einkommen.

Regierungen und Zentralbanken können verschiedene Maßnahmen zur Inflationsbekämpfung ergreifen, darunter geldpolitische, fiskalische und angebotsseitige Instrumente. Die Wirksamkeit dieser Maßnahmen hängt von den spezifischen wirtschaftlichen Bedingungen ab, und oft ist ein koordinierter Einsatz mehrerer politischer Instrumente erforderlich. Die Glaubwürdigkeit der politischen Maßnahmen ist ebenfalls von entscheidender Bedeutung, da die Überzeugung der Wirtschaftsakteure, dass die Regierung und die Zentralbank die Inflation ernsthaft bekämpfen, die Wirksamkeit der durchgeführten Maßnahmen erhöhen kann.